| CAC 40 | Perf Jour | Perf Ytd |

|---|---|---|

| 8311.74 | -0.35% | +1.99% |

| Pour en savoir plus, cliquez sur un fonds | |

| Pictet TR - Atlas Titan | 3.83% |

| Pictet TR - Sirius | 2.88% |

| ELEVA Absolute Return Dynamic | 2.79% |

| H2O Adagio | 2.43% |

| Pictet TR - Atlas | 1.91% |

| Candriam Absolute Return Equity Market Neutral | 1.37% |

| ELEVA Global Bonds Opportunities | 1.29% |

| AXA WF Euro Credit Total Return | 1.24% |

Syquant Capital - Helium Selection

|

1.16% |

| Alken Fund Absolute Return Europe | 1.08% |

| Schelcher Optimal Income | 1.07% |

| Sienna Performance Absolue Défensif | 0.96% |

| MacroSphere Global Fund | 0.81% |

DNCA Invest Alpha Bonds

|

0.81% |

| Cigogne UCITS Credit Opportunities | 0.55% |

| Candriam Bonds Credit Alpha | 0.38% |

| BNP Paribas Global Absolute Return Bond | 0.36% |

| JPMorgan Funds - Europe Equity Absolute Alpha | -0.10% |

| Fidelity Absolute Return Global Equity Fund | -0.55% |

| Jupiter Merian Global Equity Absolute Return | -1.17% |

Exane Pleiade

|

-1.67% |

| RAM European Market Neutral Equities | -2.08% |

Cette société française va dépasser les 10 milliards d’encours…

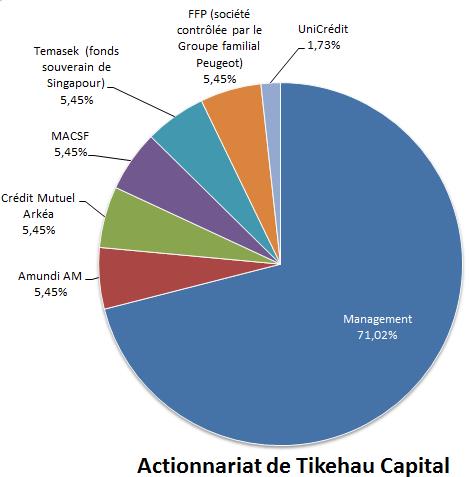

Tikehau Capital a annoncé avoir conclu un accord pour assurer la gestion déléguée de l’activité de dette senior européenne de Lyxor.

Cette opération permettra à Tikehau Capital de développer son activité leveraged loans & CLO qui passera de 1,9 milliard d’actifs sous gestion à 2,6 milliards d’euros.

La société gérait moins d’un milliard en 2011, et gère aujourd’hui 9,8 milliards d’euros.

Mathieu Chabran, co-fondateur de Tikehau Capital et directeur général de Tikehau IM a commenté : « Nous nous réjouissons de la signature de cet accord avec Lyxor qui permet ainsi à Tikehau Capital de se renforcer au Royaume-Uni et de poursuivre le renforcement de son expertise dans les leveraged loans et le crédit européens. Nous sommes heureux d’accueillir l’équipe de la dette senior européenne de Lyxor UK chez Tikehau Capital et sommes convaincus que cette transaction nous permettra de développer cette activité dans un environnement de taux bas particulièrement porteur. »

Pour en savoir plus sur les fonds Tikehau, cliquez ici

Les meilleurs fonds obligataires pour investir en 2026...

Extrait du magazine Challenges de cette semaine.

Publié le 13 février 2026

Publié le 13 février 2026

Buzz H24

| Pour en savoir plus, cliquez sur un fonds | |

| Regnan Sustainable Water & Waste | 6.92% |

| M Climate Solutions | 6.77% |

| Echiquier Positive Impact Europe | 4.15% |

| Dorval European Climate Initiative | 3.53% |

| BDL Transitions Megatrends | 3.53% |

| EdR SICAV Euro Sustainable Equity | 3.47% |

| R-co 4Change Net Zero Equity Euro | 2.95% |

| DNCA Invest Sustain Semperosa | 2.56% |

| Ecofi Smart Transition | 2.52% |

| Triodos Future Generations | 2.50% |

| Storebrand Global Solutions | 2.31% |

Palatine Europe Sustainable Employment

|

2.27% |

| Triodos Global Equities Impact | 1.65% |

| Triodos Impact Mixed | 1.28% |

| La Française Credit Innovation | 0.32% |