| CAC 40 | Perf Jour | Perf Ytd |

|---|---|---|

| 8358.76 | -0.04% | +2.57% |

| Pour en savoir plus, cliquez sur un fonds | |

| Pictet TR - Atlas Titan | 2.61% |

| ELEVA Absolute Return Dynamic | 2.56% |

| Pictet TR - Atlas | 1.31% |

| Candriam Absolute Return Equity Market Neutral | 1.10% |

| M&G (Lux) Episode Macro Fund | 0.86% |

| H2O Adagio | 0.83% |

| Sienna Performance Absolue Défensif | 0.80% |

| Fidelity Absolute Return Global Equity Fund | 0.78% |

Exane Pleiade

|

0.73% |

| AXA WF Euro Credit Total Return | 0.48% |

DNCA Invest Alpha Bonds

|

0.38% |

Syquant Capital - Helium Selection

|

0.36% |

| BNP Paribas Global Absolute Return Bond | 0.29% |

| Candriam Bonds Credit Alpha | 0.09% |

| Cigogne UCITS Credit Opportunities | 0.09% |

| Jupiter Merian Global Equity Absolute Return | -0.37% |

| JPMorgan Funds - Europe Equity Absolute Alpha | -0.50% |

| RAM European Market Neutral Equities | -1.37% |

Et + Encore

Et + Encore

Comment Cardif a rénové sa gamme ? Réponses avec Pascal Perrier, Directeur Réseaux CGP - Courtiers et e-Business…

"Et + Encore", l'émission patrimoniale de Jean-François Filliatre et Georges de La Taille est diffusée chaque mois en direct sur H24 Finance.

Publié le 15 septembre 2021

Et + Encore

Les projets d’un acteur majeur de la pierre papier...

"Et + Encore", l'émission patrimoniale de Jean-François Filliatre et Georges de La Taille est diffusée chaque mois en direct sur H24 Finance.

Publié le 14 septembre 2021

Et + Encore

Cette fois, la crise chinoise ne s'est pas propagée : le point avec Nadine Trémollières, Directrice de Primonial Portfolio Solutions…

"Et + Encore", l'émission patrimoniale de Jean-François Filliatre et Georges de La Taille est diffusée chaque mois en direct sur H24 Finance.

Publié le 10 septembre 2021

Et + Encore

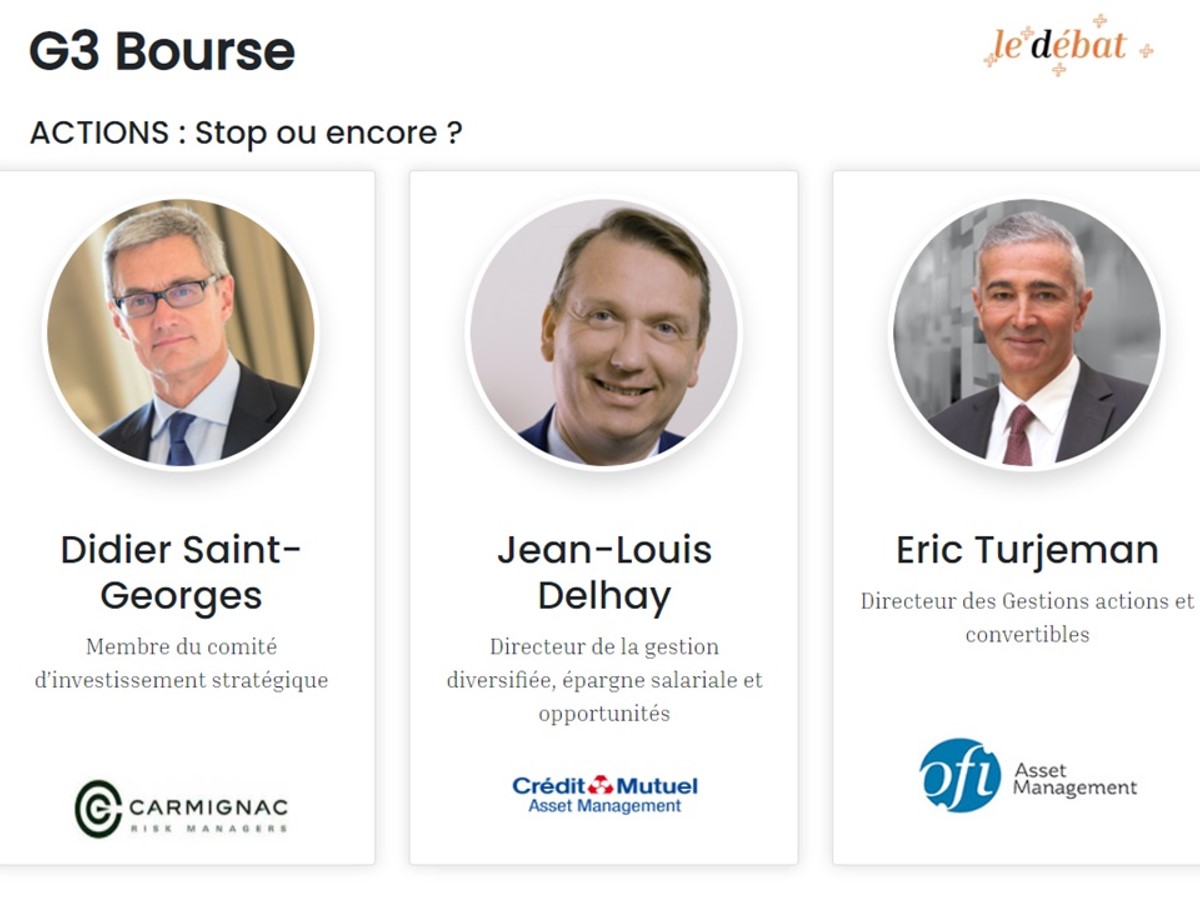

G3 Bourse - ACTIONS : Stop ou encore ?

"Et + Encore", l'émission patrimoniale de Jean-François Filliatre et Georges de La Taille est diffusée chaque mois en direct sur H24 Finance.

Publié le 09 septembre 2021

Et + Encore

Publié le 07 septembre 2021

Et + Encore

Que faire sur les actions en cette rentrée ?

Les experts du G3 Bourse y répondront mardi prochain dans l'émission "Et + Encore" de septembre

Publié le 02 septembre 2021

Et + Encore

Les Etats-Unis retrouvent le rythme : le point avec Nadine Trémollières, Directrice de Primonial Portfolio Solutions...

"Et + Encore", l'émission patrimoniale de Jean-François Filliatre et Georges de La Taille est diffusée chaque mois en direct sur H24 Finance.

Publié le 09 juillet 2021

Et + Encore

Les arbitrages recommandés par les experts Immobiliers...

"Et + Encore", l'émission patrimoniale de Jean-François Filliatre et Georges de La Taille est diffusée chaque mois en direct sur H24 Finance.

Publié le 08 juillet 2021

Et + Encore

Publié le 07 juillet 2021

Et + Encore

Primonial REIM, Perial, Amundi Immobilier, La Française REM à suivre en direct dès 18h !

"Et + Encore", l'émission patrimoniale de Jean-François Filliatre et Georges de La Taille est diffusée chaque mois en direct sur H24 Finance.

Publié le 06 juillet 2021

Et + Encore

Publié le 05 juillet 2021

Et + Encore

Reprise de l’inflation : que faire aujourd'hui sur les marchés ?

Les marchés mondiaux progressent fortement depuis le début d’année : +14% sur le S&P 500, +15% sur l’Euro Stoxx 500, +19% sur le CAC 40… Mais comment aborder les prochains mois après cette flamboyante première moitié d’année alors que l’inflation semble effectuer son retour ?

Publié le 28 juin 2021

Et + Encore

Optimale, la solution SCPI ?

À l’affiche avec David Regin, Directeur commercial Consultim Groupe…

Publié le 16 juin 2021

Et + Encore

Les marchés carburent à l'envi : le point avec Nadine Trémollières, Directrice de Primonial Portfolio Solutions...

"Et + Encore", l'émission patrimoniale de Jean-François Filliatre et Georges de La Taille est diffusée chaque mois en direct sur H24 Finance.

Publié le 11 juin 2021

Et + Encore

Les arbitrages recommandés par 3 experts des marchés...

"Et + Encore", l'émission patrimoniale de Jean-François Filliatre et Georges de La Taille est diffusée chaque mois en direct sur H24 Finance.

Publié le 10 juin 2021

Buzz H24

| Pour en savoir plus, cliquez sur un fonds | |

| Dorval European Climate Initiative | 4.33% |

| Triodos Global Equities Impact | 4.00% |

| BDL Transitions Megatrends | 3.44% |

| Ecofi Smart Transition | 3.41% |

| Palatine Europe Sustainable Employment | 3.35% |

| DNCA Invest Beyond Semperosa | 3.05% |

| Regnan Sustainable Water & Waste | 2.98% |

| Echiquier Positive Impact Europe | 2.65% |

| R-co 4Change Net Zero Equity Euro | 2.43% |

| EdR SICAV Euro Sustainable Equity | 2.42% |

| Triodos Impact Mixed | 2.05% |

| Triodos Future Generations | 1.53% |

| Storebrand Global Solutions | 1.39% |

| La Française Credit Innovation | 0.27% |